Don’t let lack of money be a reason to delay your dreams…

We all have long-term financial goals to work towards, but when dealing with your day to day cost of living, it can be difficult to see the big picture.

Our needs-based calculators offer a clearer view of how much you should be putting aside each month in order to hit your targets, and how an investment strategy can help you get there. Simply choose the goal you’re working towards and answer a few questions to see your results.

Try our savings calculators

Saving for your child’s education

Calculate how much you should be putting aside each month to help ensure the best educational opportunities for your children.

Grow your wealth

Could your money be working harder for you? Try our wealth calculator to find out how much more you could be earning with a personally tailored savings plan.

Plan for retirement

It’s never too early to start putting money aside for retirement. Discover how much you should be putting aside to help ensure that your golden years are comfortable and free from financial worries.

How it works

When you open the calculator that reflects your personal savings goal, you will be asked to answer some basic questions. This is to help us to determine your current financial situation, and how much you can afford to put aside each month.

For example, if you choose the ‘Grow your wealth’ calculator, you will be asked to provide the following information:

Understanding your results

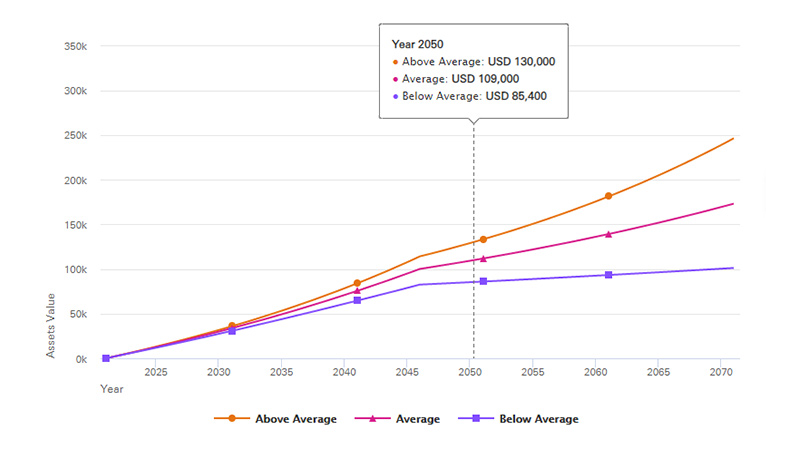

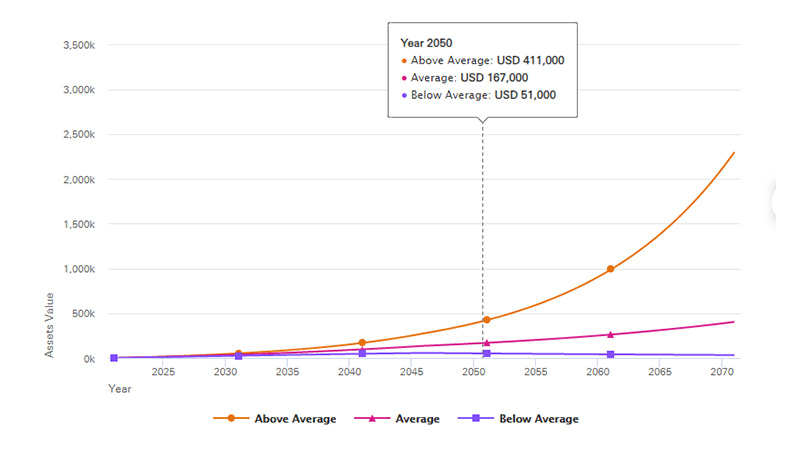

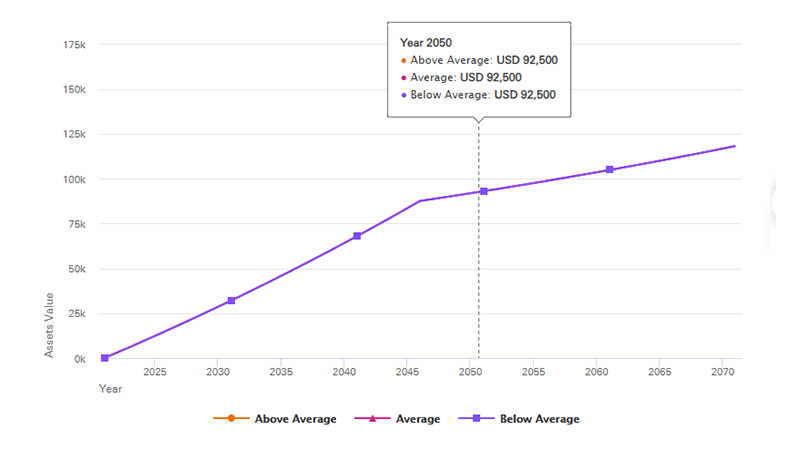

When you hit calculate, you should see a graph that looks something like this:

This is a projection of how your savings could grow over time, based on the information you provided on the form. The three lines reflect three possible outcomes, based on how your investments perform.

The line with circles projects the growth of your savings if your investment strategy performs above expectations.

The line with triangles projects the growth of your savings if your investment strategy performs in-line with expectations.

The line with squares projects the growth of your savings if your investment strategy performs below expectations.

You will see that the gap between these lines will be larger if you choose a more high-risk strategy, reflecting the increased potential for reward, but also the increased probability that you might lose money.

If you choose a secure investment risk level, you will only see a single line, as this is a savings-only option with zero investment risk.

Below the graph, you will also find a table indicating your projected balance at the time when you stop contributing to your savings pot. So if you complete the form in January 2021 and indicate that you wish to save for ten years, this table will show you your projected balance in January 2031.

For example, here is a table for a customer who desired to save $500 per month for ten years, with a balanced approach to investing:

| Projected investment return |

High investment return |

Average investment return |

Below average investment return |

|---|---|---|---|

| Funds when you stop saving |

USD 91,200 |

USD 75,700 |

USD 58,400 |

| Projected investment return |

Funds when you stop saving |

|---|---|

| High investment return |

USD 91,200 |

| Average investment return |

USD 75,700 |

| Below average investment return |

USD 58,400 |

What next?

Please be aware that these calculator tools are purely for educational purposes and do not represent any kind of guarantee. If you are interested in taking your savings goals further, please speak to one of our wealth advisers. Premier customers should reach out to their Premier relationship manager.

You can request a call back by completing an online form, or pop into one of our branches to make an appointment.

Make an appointment

Make an appointment with one of our specialists to help plan for your financial future.

Premier customers

Complete an Investment Planning form and your Relationship Manager will get back to you to arrange a financial review.

All other customers

Just give us a few details and we'll be in touch to set up your financial review.