Make your money work harder for you…

The world of investments can offer exciting opportunities to grow your wealth and achieve your long-term financial goals. However, if you're new to investing, you may also find the process a little intimidating.

At HSBC, we offer extensive support for both experienced and first-time investors. As a leading global bank, we can connect you to a diverse global investment market, while our Bermuda-based wealth specialists can offer a personal touch, working with you to create a plan that reflects your long-term goals and your attitude to risk.

If you're thinking about taking the first step on your investing journey, let us show you how…

Why invest?

Investing is way of building a pot of money for the future. The key benefit is that it could potentially provide higher long-term growth than you might achieve if you simply put your money into a savings account. The difference is that there are no guarantees - you must be comfortable with the risk that a fluctuating investment market could leave you with less money than you put in.

However, this risk can be managed depending on your outlook. You could choose an investment plan that maximises your potential for growth at the cost of a higher risk of financial loss. Or you could opt for a more stable investment which is less likely to lose money, but will also be more limited in its growth potential.

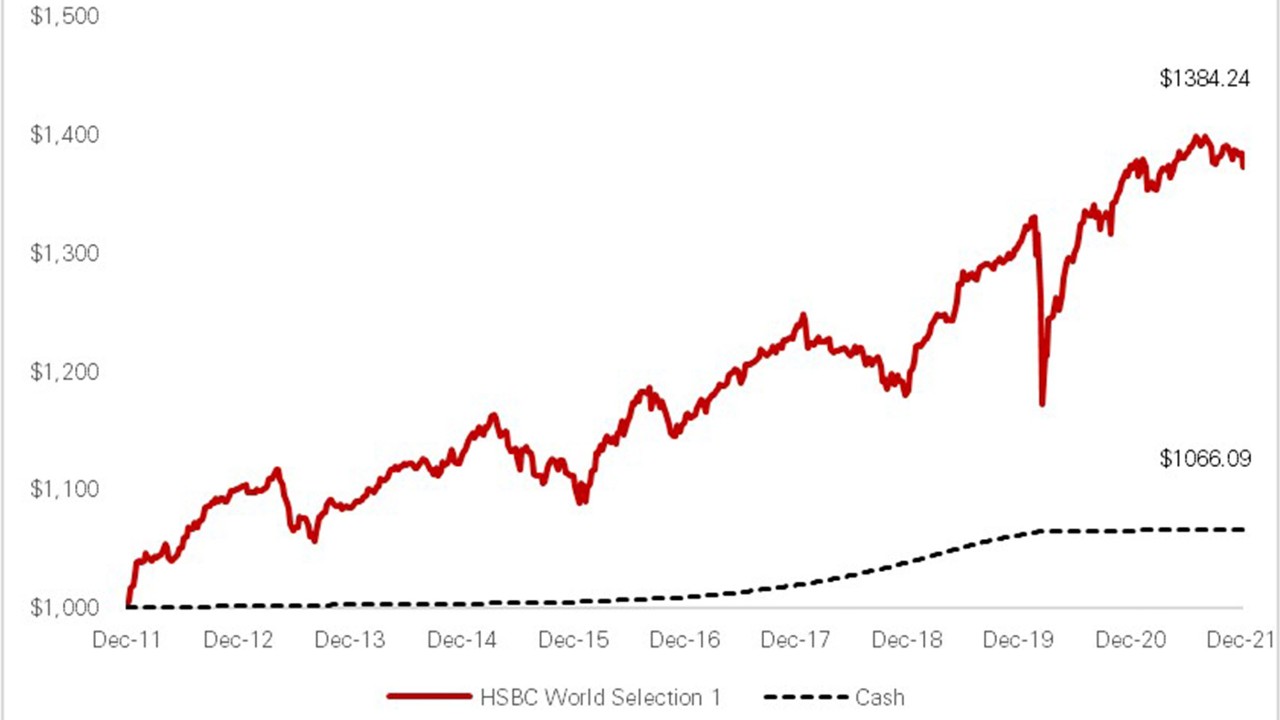

Indicative example

This chart shows the return on $1000 invested in the HSBC World Selection 1 Fund and a Barclays Cash Index.

HSBC's World Selection 1 Fund has the lowest risk out of our range of 5 funds, meaning it is designed for more cautious investors.

The chart shows that $1000 invested in our World Selection 1 Fund on 1 December 2011 would have been worth $1384.24 by 30 December 2021. By comparison, $1000 in a cash savings account would have been worth $1066.09 on the same date.

Remember, even a relatively stable investment strategy can have its ups and downs. Also keep in mind that past performance is not a reliable guide to future returns.

How much do I need to get started?

You can start an investment plan with HSBC with as little as $1,000 lump sum, or $100 per month in a regular investment plan.

How long should I invest for?

You should look at investing as a long-term strategy. We recommend planning to invest for at least 5 years to give you a better chance of riding out any short-term market fluctuations.

However, this is just a guideline. If you need to withdraw your money, you can do so at any time, without paying any exit fees.

What should I invest in?

We offer a range of investment plans to suit your personal circumstances and preferences. Your personal wealth specialist will discuss this with you in depth and help you reach your own conclusions.

Many first-time investors choose to invest in multi-asset funds. These are ready-made investment baskets which can be managed on your behalf by one of our wealth specialists.

The key benefit of a multi-asset fund is that it spreads your money across a range of investments, which can reduce your risk of financial loss. If one of the investments in your fund goes down in value, it may be balanced by another that performs better over the same time period.

How much risk should I take?

The level of risk you take with your investments is a very personal choice. It should be based on your level of financial security and your attitude towards potential risk and uncertainty.

A lower-risk fund will aim to achieve a modest but stable return on your investment, whereas a higher risk fund offers a greater potential reward, but increases your risk of substantial loss.

Our wealth specialists can work with you to determine your risk profile at your free, no-obligation initial consultation.

Why invest with HSBC?

As a leading global bank, we offer access to exciting investment opportunities in major markets from New York to Hong Kong, with face-to-face support from our dedicated local investment specialists. That's why thousands of customers around the world have chosen to invest with us.

- Start with as little as $100 per monthInvesting is not just for the super-rich. You can start an investment portfolio from just $100 per month, or with a lump sum of $1000.

- Be part of something biggerBy combining local and overseas investment opportunities, we can help you to broaden your horizons while reducing your overall risk.

- Keep track of your investmentsOur banking platforms make it easy to track the progress of your investments and top them up at any time. Our wealth specialists can handle the rest, so you don’t need to worry about day-to-day management of your funds.

How to start investing

Premier customers

Complete an Investment Planning form and your Relationship Manager will get back to you to arrange a financial review.

All other customers

Just give us a few details and we'll be in touch to set up your financial review.

You might also be interested in

Investment calculator

Find out how much more you could be earning with a personally tailored savings plan.

Financial planning services

Whatever your financial goals, working with a dedicated financial planning professional can bring you one step closer to achieving them.

Sustainable investing

Learn more about our commitment to offering sustainable investment products that are informed by Environmental, Social and Corporate Governance (ESG) principals.

Important information

The value of investments and any income they generate can go down as well as up, meaning you may not get back the full amount you invested. Past performance is not indicative of future performance.

These products and services are offered only in jurisdictions where and when they may be lawfully offered by HSBC Bank Bermuda Limited and the material on these pages is not intended for use by persons located in or resident in jurisdictions which restrict the distribution of this material by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. These pages should not be regarded as an offer or solicitation to sell investments or make deposits in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdictions. This information is not intended to provide professional advice and should not be relied upon in that regard. Persons accessing these pages are advised to obtain appropriate professional advice where necessary.

Issued by HSBC Bank Bermuda Limited, of 37 Front Street, Hamilton Bermuda, which is licensed to conduct Banking and Investment Business by the Bermuda Monetary Authority. HSBC Global Asset Management (Bermuda) Limited of 37 Front Street, Hamilton, Bermuda, is a wholly owned subsidiary of HSBC Bank Bermuda Limited. Funds managed by HSBC Global Asset Management (Bermuda) Limited are offered by prospectus only in those jurisdictions where they are permitted by law. HSBC Global Asset Management (Bermuda) Limited makes no representation as to the suitability of the funds for investors. HSBC Global Asset Management (Bermuda) Limited is licensed to conduct investment business by the Bermuda Monetary Authority.

Disclosure

Issued by HSBC Bank Bermuda Limited, of 37 Front Street, Hamilton Bermuda, which is licensed to conduct Banking and Investment Business by the Bermuda Monetary Authority.